For the past few years, the issue of housing affordability has escalated into a crisis across the United States, impacting regions from coast to coast. While some areas may see slight improvements, the challenges remain profound. Understanding the dynamics of this crisis is crucial, especially for individuals navigating major life transitions such as divorce, relocation, or career changes in communities like San Luis Obispo and the broader Central Coast.

Housing Affordability Snapshot

In the fourth quarter of 2023, the Home Affordability Report highlighted by ATTOM Data Solutions unveiled a stark reality: median-priced single-family homes in nearly all U.S. counties remained less affordable compared to historical averages. This trend, which began in 2021, persists, with homeownership requiring disproportionately high wages. The housing expenses-to-wages ratio surpasses the 28% mark preferred by lenders, reaching its highest level since 2007.

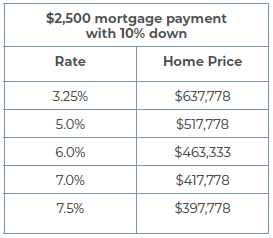

Home affordability graph illustrates the decrease in purchase power as interest rates rise. The Illumni Institute, 2024.

Factors Contributing to the Crisis

Rising Interest Rates

The Federal Reserve’s response to inflation led to a series of interest rate hikes, impacting mortgage rates significantly. From the historically low rates seen in late 2021, mortgage rates soared, with the 30-year mortgage rate peaking at 7.79% in October 2023. This surge in rates precipitated a sharp decline in mortgage applications, exacerbating affordability challenges for prospective homebuyers.

Rising Home Prices

The post-pandemic economic resurgence fueled unprecedented increases in housing prices since 2020. Contributing factors include record-low mortgage rates, supply shortages, and disruptions in construction material supply chains. Despite the surge in interest rates, home prices continued to rise due to persistent supply constraints, intensifying competition among buyers.

Lack of Inventory

Sellers hesitated to list their homes amidst uncertainty surrounding rising mortgage rates, perpetuating a shortage of available housing. Although new home construction has shown signs of improvement, challenges such as high construction costs and bureaucratic delays persist, hindering efforts to alleviate supply constraints.

Stagnant Wage Growth

While housing prices surged, wage growth failed to keep pace, widening the affordability gap. The disparity between rising home prices and stagnant wages has deterred many potential first-time homebuyers, forcing them to continue renting. For Millennials and others, homeownership has become increasingly elusive, particularly in high-cost areas like San Luis Obispo County.

Redefining the American Dream

Owning a home has long been synonymous with achieving the American Dream, yet for many, this aspiration remains deferred amid the current housing affordability crisis. However, there is reason for cautious optimism. Some experts predict a potential decrease in interest rates in 2024, which could alleviate some of the affordability pressures. As the housing market evolves, individuals facing major life changes can take solace in the anticipation of a more favorable landscape in the future.

Contact a member of the Lindsey Harn Group to learn more about current local market conditions and to plan your next real estate move.